Morning Brief

Market sentiment looks to be improving at the start of the new trading week after news broke over the weekend that this weeks Jackson Economic Symposium will be held virtually, pushing back expectations that FED Chair Powell will announce tapering QE.

The evidence is clear in terms of the market reaction that traders and investors have significantly scaled back their expectations, with the S&P 500 futures rising and Asian indices posting strong gains this morning.

See real-time quotes provided by our partner.

Perhaps the most interesting market reaction is in the US dollar, with commodity-related currencies, such as the USDCAD pair, selling-off broadly and the euro currency jumping well above the 1.1700 level.

Looking at other market sectors, Crude and Brent are posting strong gains, with Crude oil trading over 1.50 percent higher and Brent oil gaining over 2 percent. Both need to rack-up double-digit gains still to erode this month’s losses.

See real-time quotes provided by our partner.

Gold, silver, and copper are also rising in the precious metals space. Silver appeared extremely oversold on the technical front and is the strongest gainer amongst the three precious metals.

Bitcoin is trading back above the $50,000 level this morning on the Jackson Hole news, plus other bullish news had broken that PayPal is going to offer UK clients the ability to buy, sell, and hold cryptocurrencies.

See real-time quotes provided by our partner.

Both AUDUSD and NZDUSD opened lower today after a further jump in coronavirus cases over the weekend in both countries. Also, riots in Australia’s two largest population cities, Sydney and Melbourne, with significant violence from rioters in Melbourne.

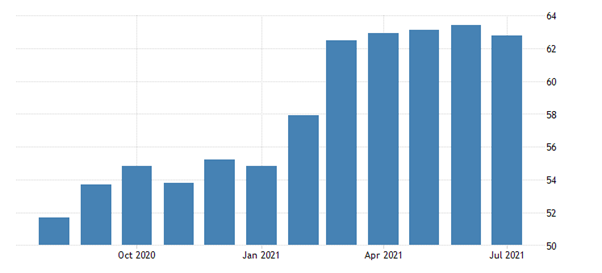

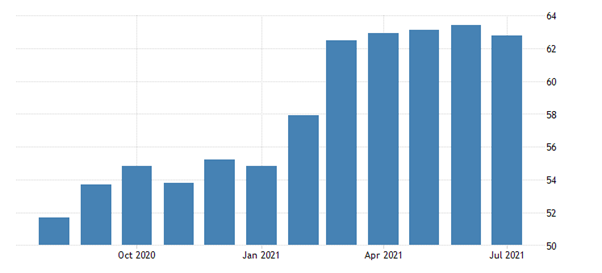

Looking ahead to the European trading session the release of preliminary eurozone and United Kingdom PMI manufacturing data for the month of August are set to headline the economic docket.

Given that expectations are high, any big miss in these data points could rock the euro and pound currencies. If we do see both coming in-line with the markets expectations then expect more US dollar weakness.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.