Market Brief

See real-time quotes provided by our partner.

After yesterday’s gains on Wall Street, Asian equities are mostly higher this morning. The exception is the Hang Seng closed trading -0.41% lower, though the futures have since moved higher. In the overnight session, we had news from the BoJ meeting. The central bank left its monetary policy unchanged as expected. While their meeting report mentioned that it needed to watch the increasing cost of imports very carefully, it also cited all the downside risks to economic growth. The Nikkei 225 closed higher.

See real-time quotes provided by our partner.

An inside day like we saw print yesterday is a great set up for breakout traders in a strong trending move. The pause before the BoJ can now resume to the upside with the 120.00 big figure the most obvious target. The 119.856 is a 1.618 fib extension from the COVID-19 pandemic low to the preceding significant high. So if we do get long the UJ after 100 pips we should take some profits.

The Shanghai Stock Exchange is currently up 1.12% leading the global indices as China’s President Xi signalled a shift in its Covid fighting strategy to reduce the impact on the economy. There could be a significant stimulus package to accompany the rate drop but everything is pivoting on the supply chains. With regards to the geopolitical situation in Ukraine, the US once again advised China not to support Russia’s invasion of Ukraine. Chinese Foreign Ministry spokesman Zhao Lijian said at a briefing today that the United States’ efforts to put pressure on the Chinese government over the Ukraine crisis are “irresponsible” and “useless.” President Biden is scheduled to meet with Xi today to assess where China stands regarding Russia’s actions.

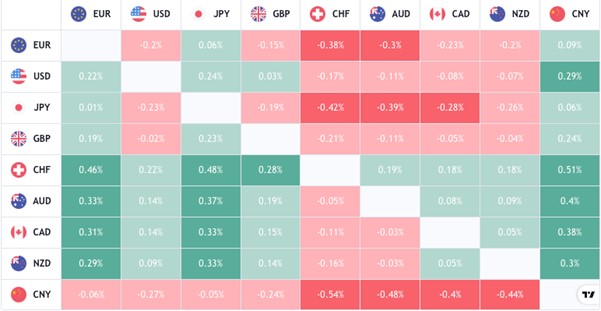

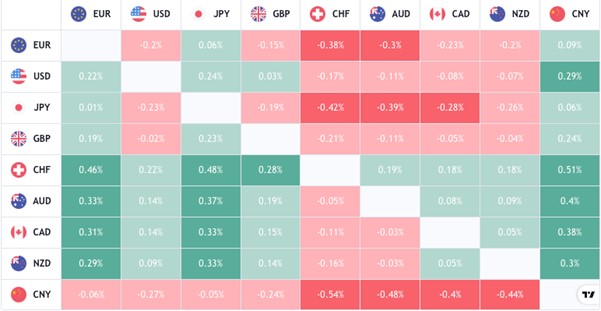

Market risk appetite is generally improving, and the volatility index (VIX) has started to trade back under the 30 level. The lower price of energy and the hope that peace talks in Ukraine might work are a couple of factors contributing to a shift in sentiment and at the London open we’re seeing a move into the commodity pairs and the beginnings of a move away from the safe-haven currencies. The Swiss franc opened as the strongest currency today, so I am expecting the SNB to step in if this continues.

The markets will look for further commentary from US Federal Reserve and Bank of England officials in the coming days after this week’s hike in interest rates. The Federal Reserve and Bank of England will both make speeches over the course of today and next week. Two Fed speakers will speak today, and we hope to have clarity on the Fed’s position with regards to the focus on inflation over economic growth. Fed Chair Powell hammered home that it is the Fed’s current thinking that a strong economic base from which to build upon comes with price stability. They are poised to tighten monetary policy aggressively by raising interest rates and selling off assets. Consequently, today’s speeches may not offer much of a breakthrough, but the headline risk comes from any sense of a walk back in the hawkish stance.

See real-time quotes provided by our partner.

The GBPUSD found resistance from the 1.3200 level after sweeping the highs of 10th of March. Current price action is within yesterday’s range, but the bears are currently in control with 1.3000 a great target over the coming weeks.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.