Forex Analysis

According to the minutes of the Federal Reserve’s meeting, most participants intend to hike by 50 basis points at the next two meetings. In addition to the third-rate hike in a row, it will bring interest rates to 2% by July. Markets are pricing in a 2.75% interest rate for the end of the year, and currently there is around a 58.9% probability of this playing out. The reason for this is that many of us are questioning whether the Fed can really contain inflation without triggering a hard landing. Fed Chair Powell even said that there would now be some pain involved with the current monetary policy as they attempt to curb demand and cool the economy.

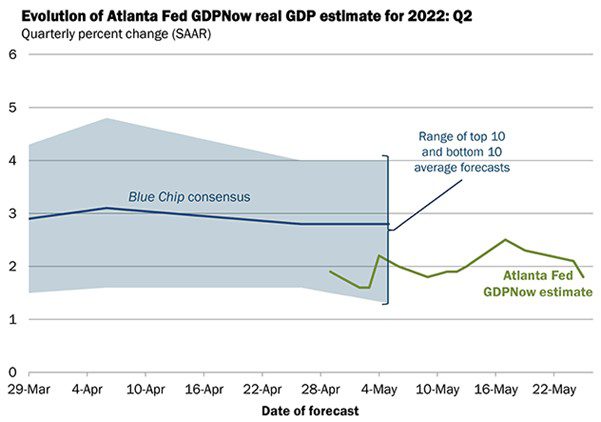

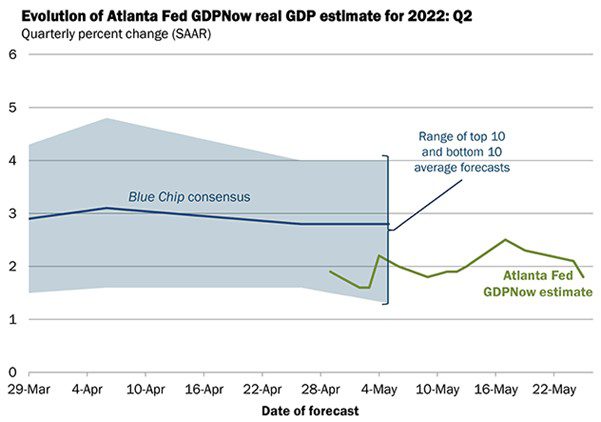

Today’s second revision to US GDP will be of great interest after the previous release showed growth unexpectedly contracted by -1.4%. The Atlanta Fed GDPNow model is also currently pointing lower. Today, the Fed will need to see an upward revision to Q1 GDP to prevent stagflation concerns from becoming exacerbated and casting doubt over market rate hike expectations. As much as the Fed talk about having the tools, they generally just do what the market indicates that they should do. And when they ignore these calls, we get into a situation where the Fed is behind the curve.

This week, we heard FOMC members mention that it is possible they will have to pause raising rates in September. This was within the plan at the start of the rate hike cycle, as they need at least 90-days of evidence to assess whether their policy is working as they expected. Therefore, it was predictable that the recent minutes would stop short of stating that 50 bps hikes are expected after July.

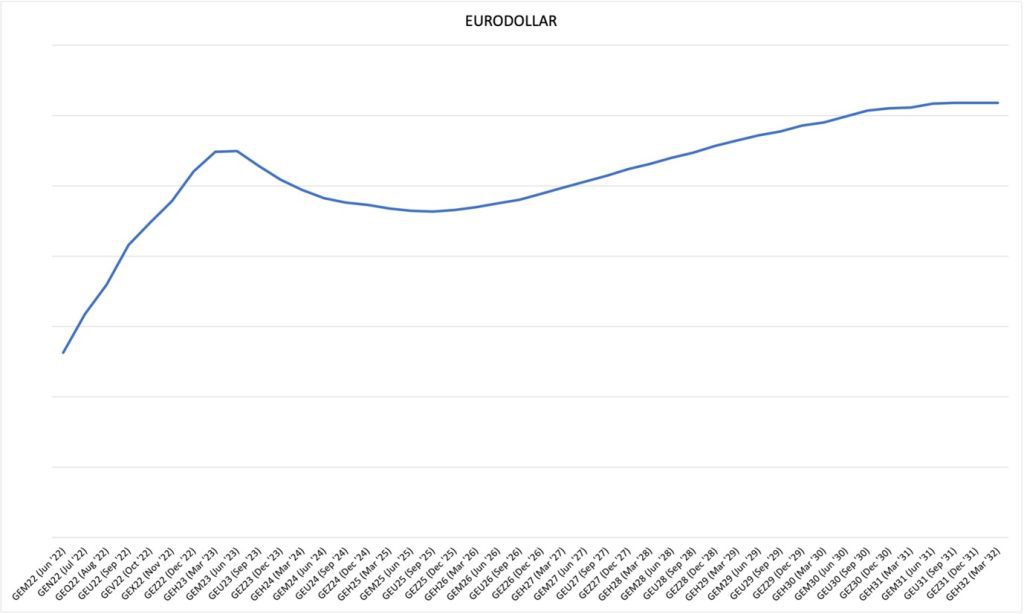

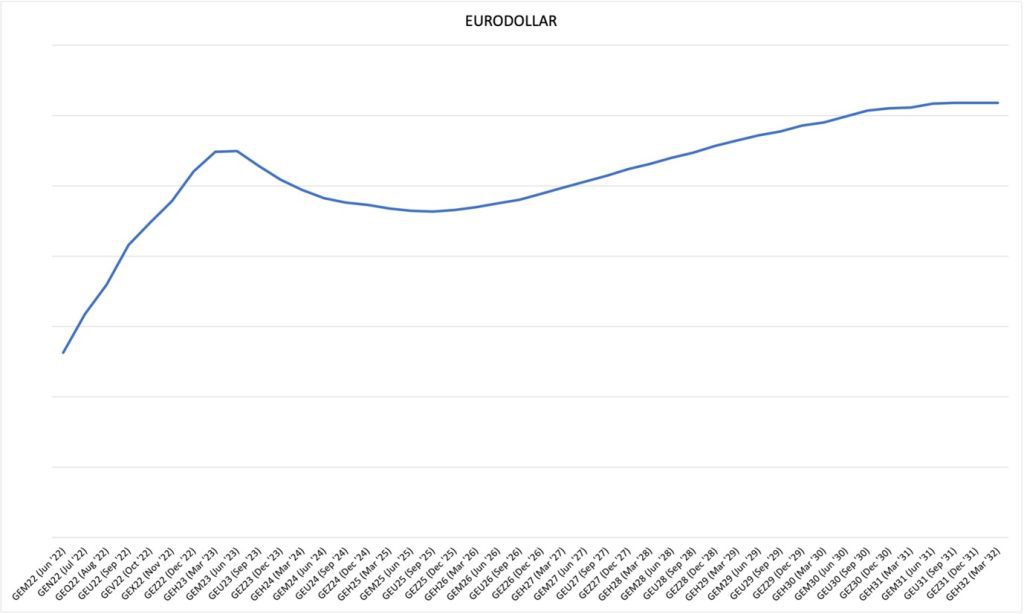

The Eurodollar market has become more concerned about the current near-term outlook, and we are seeing the inversion in the yield curve occur closer to the dates that the Fed has the most influence over. An inversion shows that the deepest and most liquid of markets, which attracts the most sophisticated of money managers, is not happy and that there is uncertainty coming very soon. The curve had been inverted further into the future, but has recently started to move higher, which is at least optimistic into the next presidential term.

If the Fed look at tomorrows PCE data and see a stall in the rise in inflation, and then add in the weakening GDP and money market concerns, the late summer FOMC meeting minutes may not be as hawkish as we had first though they could be. Which would translate into a weaker US dollar and a drop in the yield curve as traders reprice interest rates nearer to 2%.

See real-time quotes provided by our partner.

The US dollar has dropped over the last 2 weeks, and I believe tomorrows PCE and next week’s NFP will have a real influence on what the Fed do post July. If the data is weak this will set the tone in the market sentiment and set expectations for a less than expected hawkish rate hike rise, just as we’re seeing in the GBP from the BoE’s dovish rate hike decisions. The central banks cannot afford to go too hard if the economy is fragile.

If the inflation data is still pointing higher for longer, the US dollar will no doubt close above the daily 9-period EMA and we’ll try and go long for a retest of the May 2022 highs.

Currently, I have key resistance at $102.795 and a break of this week’s low and my next level of support would be $100.650. Trading either side of those levels and we could be on for an extended move.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.