Morning Brief: 13/04/2021

US 10-year Treasury yields are on the rise this morning, as the bond market starts to position itself for today’s CPI inflation report from the United States economy. US 10-year yields are currently tracking 3 basis point higher, around 1.70 percent.

Market participants are expecting today’s US CPI inflation report to be the start of a bump in inflation; however, the Federal Reserve are just expecting inflation to be transitory and indeed not sustainable.

See real-time quotes provided by our partner.

The market reaction later today should be fascinating and is likely to set the tone for financial markets this week. The US dollar index is certainly one to watch and is already slightly higher on the day as traders expect a solid monthly and year-on-year increase in CPI today.

Hong Kong’s Hang Seng and the Nikkei225 are on the rise and both finished close to one percent in the green today. The USDJPY pair is benefitting from US dollar strength and is testing back towards the 110.00 handle after a soggy start to the week.

Antipodean currencies are both coming under pressure as the greenback starts to firm. The AUDUSD is the weakest antipodean and appears to be closely tracking the price of gold right now.

See real-time quotes provided by our partner.

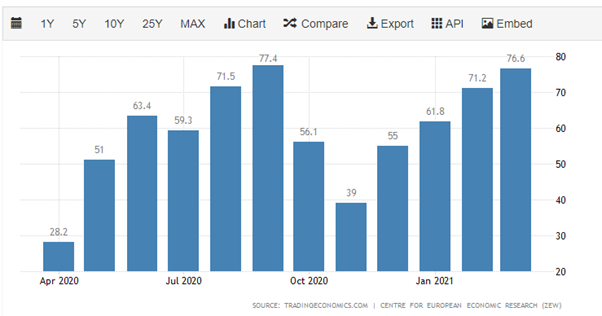

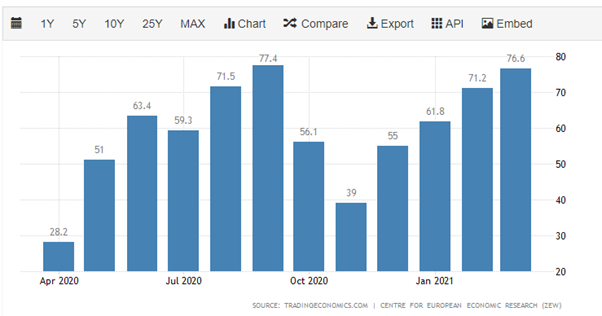

Sterling is notably weak ahead of today big data releases. The British pound faced another big rejection from the 1.3780 level yesterday. The FTSE100 had a bad yesterday despite the UK coming out of lockdown. Euro traders will be closely focused on ZEW data from Germany this morning. The EURUSD pair is consolidating around its 200-day moving average as the pair searches for a new short-term directional bias.

Bitcoin is once again back above the $60,000 level this morning. Bullish sentiment is engulfing the top coin today as reports suggest that Coinbase’s IPO valuation could reach as much as $100 billion on Wednesday.

Data Watch

The economic calendar during the European session is heavily focused on ZEW data from both the German and EU economy. The EU and German ZEW is expected to see a pick-up, with economic sentiment and current situations reading showing an improvement on the previous month.

During the United States trading session the US consumer price index inflation report promises to generate tremendous market volatility. Year-on-year CPI is expected to increase to 2.5 percent today.

Market participants are likely to react by buying the greenback and selling stocks if CPI inflation comes in hot. Federal Reserve Jerome Powell’s scheduled speech on Wednesday will also be closely watched to see the FED Chair’s current thoughts on inflation.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.