The British pound stole the headlines during an extremely lively Asian trading session today, as risk-on trading sentiment caused a major move higher in British currency against a basket of top currencies.

Sterling spiked towards the 1.4240 level, marking the highest trading level for the GBPUSD pair since April 2018. The sudden jolt higher is being attributed to risk-on trading sentiment and a huge amount of stop losses being triggered in the EURGBP pair.

The EURGBP pair collapsed towards the 0.8550, as the divergence between European and UK fundamentals continue to widen. The UK government has recently announced plans to exit lockdown and UK Chancellor Sunak has outlined plans to further shore-up the UK economy this year, while the German economy and much of Europe remains in lockdown.

Aside from the British pound, the US dollar has started to firm as Asian equity markets start to suffer losses, following another red candle day on Wall Street yesterday. The Nikkei 225 was close to eroding its weekly gains, after suffering intraday losses of -1.5 percent.

The Australian dollar pulled back from a multi-year high of 0.7945, as Asian bourses turned lower and commodity prices started to stabilize, following days of strong gains as the reflation trade gathers pace.

Earlier today the Reserve Bank of New Zealand kept interest rates on-hold and left monetary policy unchanged. The market appeared disappointed, as many investors were expected the RBNZ to strike a more hawkish tone.

In terms of the market reactions, the New Zealand dollar started to fall on the policy announcement, however, the kiwi started to stabilize after the initial sell-off and is now clawing back its earlier losses.

Oil prices slipped after the API weekly oil report from the US showed a surprise build up in oil stocks. WTI and Brent oil traders are taking the news in the stride today, placing the overall uptrend firmly in place.

Market sentiment improved on Wall Street after FED Chair Jerome Powell reaffirmed his commitment to ultra-loose fiscal policy. Powell noted that inflation remains subdued and that the central bank would continue to provide massive QE stimulus.

Data Watch

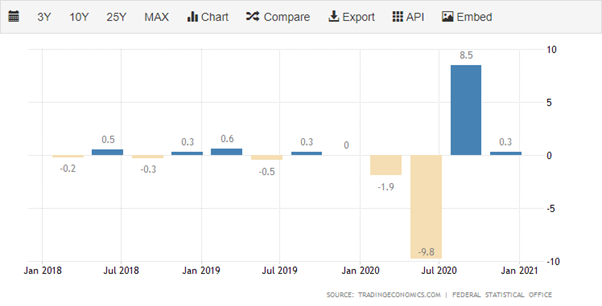

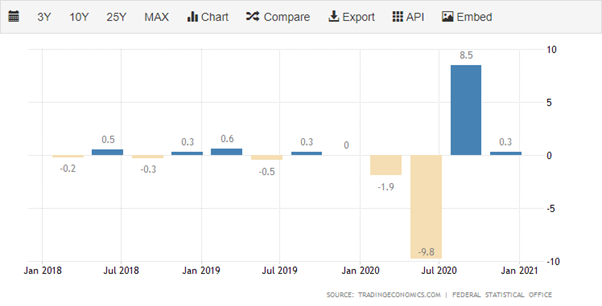

During the European session, the release of German Gross Domestic Product data is set to be the main event. Market consensus has the German economy growing by +0.1 percent on a quarterly basis. The euro currency and the DAX could take a hit if the German economy fails to move in a growth in Q1.

Federal Reserve Chair Jerome Powell’s speech on Capital Hill is going to be the main event going into the US trading session. Powell has been giving off dovish vibes so far this week, so further support for equity markets, and US dollar weakness should be expected.

Traders now have a date for the upcoming US stimulus vote. The House of Representatives will vote on the Biden administrations $1.9 billion stimulus package this Friday. This will be a big market focus going forward.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.