Today we see the release of the March United States retail sales report, with many economists predicting a blockbuster number following the recent rollout of $1,400 stimulus checks to US citizens.

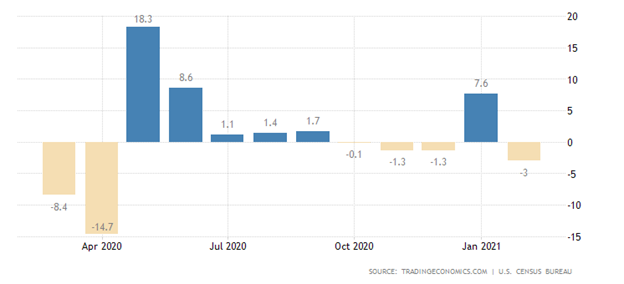

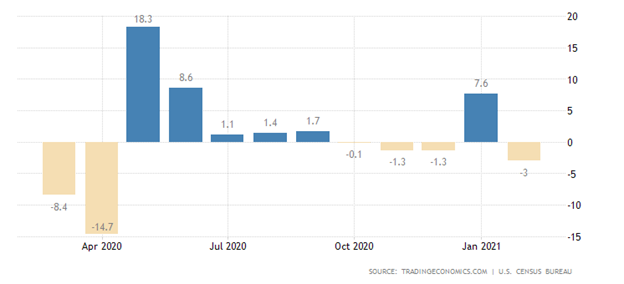

Estimates for today’s retail sales number are wide ranging. Many of the leading investment banks are calling for a monthly headline between 3.8 percent and 11.5 percent, which is a major improvement on last month negative headline number.

Better-than-expected weather for this time of year in March, and $1,400 stimulus checks hitting most US citizens bank accounts in early-March are some of the reasons why analysts are becoming hawkish on today’s retail sales report.

In terms of what is officially expected, the consensus is for a 5.5 percent headline number, while the previous months retail sales number has been revised to -3.3 percent, which is slightly down on the initial 3.0 percent number.

Digging into what the banks are forecasting, some eye-catching headline numbers are being predicted for today. NatWest bank is calling for a 10 percent monthly increase in retail sales, with the bank citing stimulus checks, record auto sales, and increased usage of restaurants.

Bank of American are even more bullish. The bank has said that they expect headline and core CPI to surge today, with both numbers hitting 11 percent. Again, they talk-up stimulus and better weather as a potent cocktail for better consumer spending.

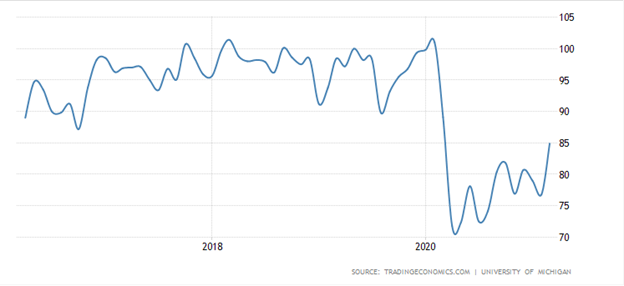

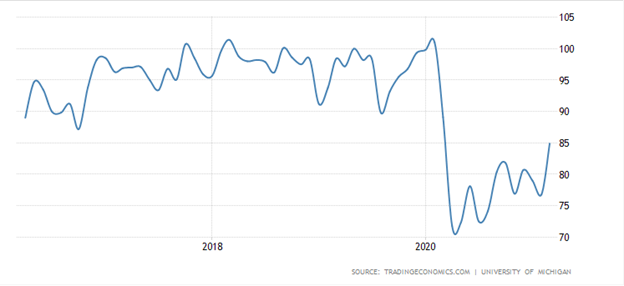

Should we see a strong retail sales number today as many bank analysts and economists are predicting then this bodes well for tomorrow’s US consumer sentiment index, which is a key survey on personal consumer spending, and confidence in the US economy.

If today’s retail sales number comes in hot, then a multi-year high Michigan consumer sentiment reading above 90 is highly likely. This could be extremely bullish for the US dollar and US stocks.

Recent rallies in the US dollar index have been sustained, and stronger, when bond yields start to rise, with particular attention given to the movements of the 10-year yields.

Perhaps the key to today’s retail sales number will be the reaction of the US bond yields. Should we US yields rising sharply then it should be a boon for the US dollar currency, however, rising yields could spook stocks.

Typically, retail sales numbers are highly volatile, so a sustained multi-month trend of strong retail sales numbers could be needed to convince the bond market that the US consumer is back to its old spending habits.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.