During the upcoming trading week, the release of the United States Non-farm payrolls job report is set to be the main focus for financial markets, following last month’s blockbuster 900,000 plus headline number.

Other key highlights on the economic docket this week include the Bank of England and Reserve Bank of Australia interest rate decisions and monetary policy statements, and the ISM manufacturing report.

This week will also see retail sales numbers from eurozone and Germany, monthly jobs data from the Australian and New Zealand economies, and the Bank of Japan meeting minutes.

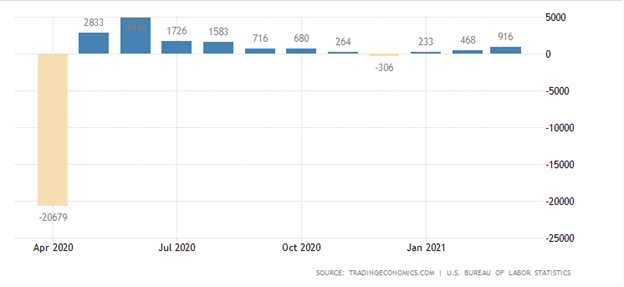

Non-farm Payrolls Job Report

Traders will be braced for another extremely strong Non-farm payrolls job report this week, with many analysts predicting that the United States economy created 925,000 new jobs in April.

Investors will also be on the lookout for any revisions to last month’s blockbuster 916,000 headline number. Additionally, the US Unemployment rate is predicted to have dropped to 5.8 percent, which is down from the 6.0 percent headline number recorded last month.

As the United States economy comes out of lockdown the American employment situation is only expected to improve. The market reaction is likely to be positive for stocks and the greenback if Friday’s job report comes in broadly in-line with the markets expectation.

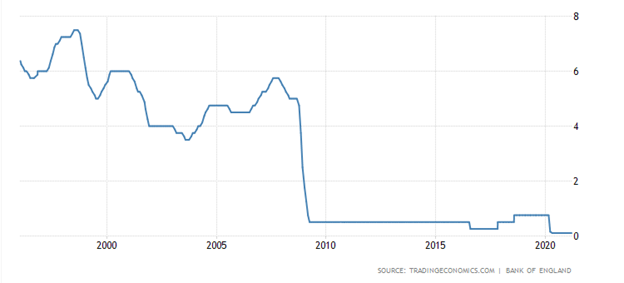

Bank of England Rate Decision

Analysts remain on the fence this week as to whether the Bank of England is going to cut bond purchases, as the United Kingdom starts to come out of lockdown. Coming out of COVID-19 lockdown looks to have ended months of sub-par growth.

The central bank voted unanimously to keep its benchmark interest rate on hold at a record low of 0.1 percent at the last meeting, and to leave its bond-buying program unchanged.

Bank of England members noted that the UK GDP was projected to recover strongly over 2021 towards pre-Covid levels and CPI inflation was expected to return towards the 2 percent target in the spring.

It is possible that the UK central bank may strike a mildly bullish tone during this week’s meeting and cut bond purchases as the economy improves, which should be price positive for the FTSE100, FTSE250, and sterling.

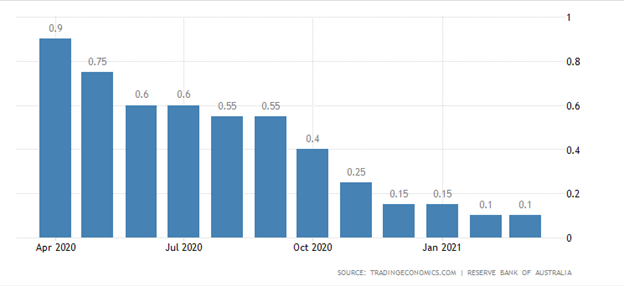

Reserve Bank of Australia Rate Decision

The Reserve Bank of Australia is expected to remain on-the-fence this week, despite the economy doing better than the central bank anticipated since the last meeting.

The RBA left its cash rate unchanged at a record low of 0.1% during its April meeting, as widely expected. Policymakers also reaffirmed their commitment to maintaining highly supportive monetary conditions until at least 2024 when actual inflation is sustainably within the 2 to 3% target.

Most policymakers noted that they remain unconcerned about CPI inflation, as inflationary pressure is expected to rise temporarily because of the reversal of some COVID-19-related price reductions.

Watch out for the Australian dollar to lift if the Australian central bank strikes a most positive tone. The pace of gains in the Aussie really depends on if the central bank leaves the door open to cutting future bond purchases.

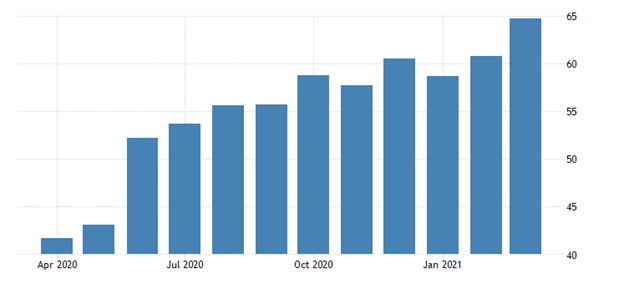

ISM Manufacturing Report

The ISM Manufacturing PMI is expected to come in at 64.9 this week, after the ISM PMI jumped sharply to a 64.7 reading last month from 60.8 in February.

The 64.7 reading was well above market forecasts of 61.3, and it further underscored that the US manufacturing sector is currently enjoying its strongest period of growth since December of 1983.

The fastest increases were seen in production, new orders, last month which were at their the highest since January of 2004, and employment.

Both new export orders and supplier deliveries slowed a bit and price pressures remained elevated. Inflationary pressure should be a key theme that traders are watching inside this week report.