During the upcoming trading week, the economic calendar is heavily dominated by central bank policy meeting, as we see the Bank of Canada, Bank of Japan and European Central Bank all deciding on interest rates.

Other key highlights on the economic docket this week include the release of the German CPI data, at a time when energy prices are surging. We also see key preliminary GDP and Durable Goods data from the US economy.

This week will also see the release of Australian CPI inflation and Retail sales number, and IFO and GDP data from the German economy. Eurozone GDP is also on the menu this week.

European Central Bank

ECB policymakers are likely to face a flurry of questions surrounding rising energy prices in the eurozone economy this week, with most economists expecting that the central bank will maintain rates and QE, but up their inflation forecasts.

Last month, the ECB discussed a bigger cut in asset purchases and some even argued that markets were already expecting an end of stimulus by March 2022, minutes from the ECB September monetary policy meeting showed.

The ECB has also lifted its growth and inflation forecasts for this year. Inflation is now seen at 2.2% in 2021 (vs 1.9% estimated in June), 1.7% in 2022 (vs 1.5%) and 1.5% in 2023 (vs 1.4%). This week they could raise them further.

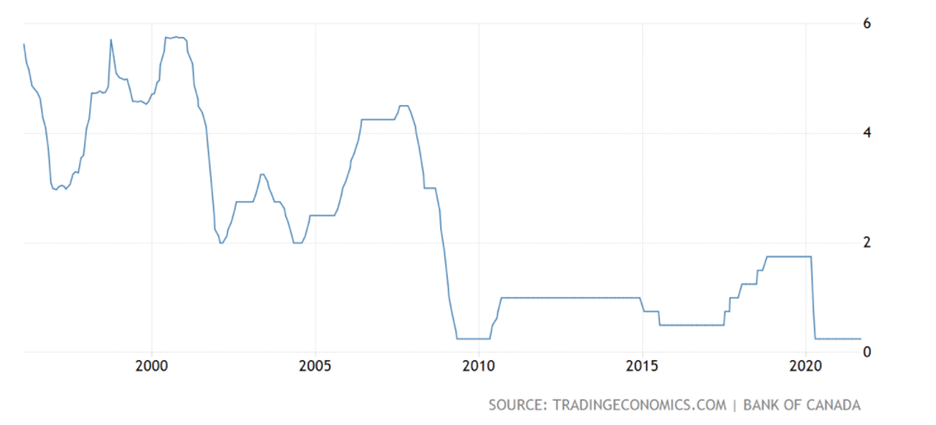

Bank of Canada

The Bank of Canada is likely to be in the same spot as the ECB and other central banks in that they will have to address rising inflationary pressure in their policy speeches.

Last month the Bank of Canada held its target for the overnight rate at 0.25% on September 9th, 2021, in line with forecasts, and maintained the quantitative easing program at a target pace of $2 billion per week, following a $1 billion cut in the previous meeting.

Rate hikes are possible, as the BOC is amongst the most hawkish central bank and especially after the recent blockbuster jobs report. It should be noted that the bank remains committed to holding the policy interest rate at the effective lower bound until economic slack is absorbed so that the 2% inflation target is sustainably achieved.

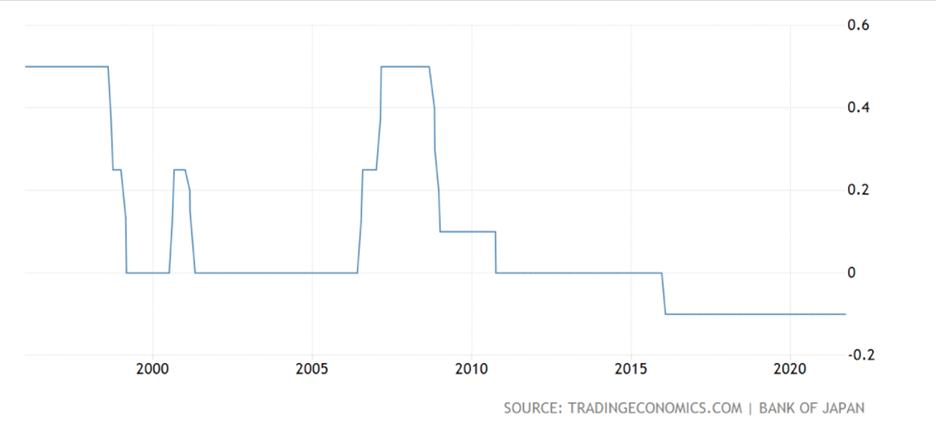

Bank of Japan

The Bank of Japan is unlikely to throw up any surprises this week, it will be interesting to see how the central bank addresses the lack of inflation in the Japanese economy.

The BoJ reiterated last month that it will not hesitate to take more easing measures if necessary while expecting short-and-long-term policy rates to remain at their present or lower levels. The central bank also said it will start to roll out climate change loans in December.

On the price front, the yoy rate in the CPI has been around 0%, amid a rise in energy cost and despite a drop in mobile phone charges. Meanwhile, inflation expectations have been more or less unchanged, which makes the Japanese yen currency a fascinating carry trade right now.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.