Morning Brief

Market sentiment is attempting to improve in early-Wednesday trade as market participants digest the recent slowdown in Chinese economic data and the rise in COVID-19 cases globally, and of course the latest lockdown in New Zealand.

The US dollar index is holding firm after enjoying strong demand yesterday amidst safe haven buying demand. All eyes will be on the 93.20 to 93.40 price zone today and whether bulls can stage a breakout above that area or whether risk-on sentiment will cause the buck to sell-off again.

Gold is trading higher, which further hints that risk-off tones are still lingering, however, US 10-year yields are rising and already up 1.4 basis points. On the positive front S&P 500 futures and European futures are mildly positive and the Nikkei closed the day 0.9 percent higher.

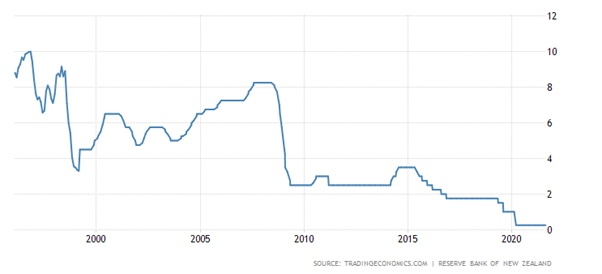

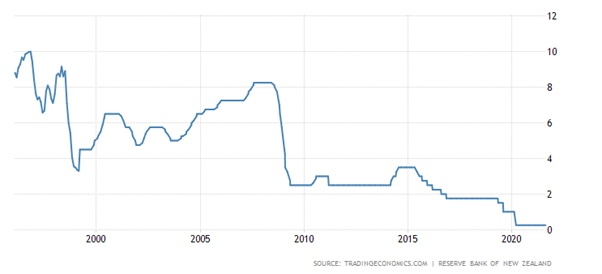

A very lively Asian session today doe to the Reserve Bank of New Zealand policy decision, which had been the subject of much-speculation this week due to the fact that investors were actually expecting a rate hike.

With New Zealand back in lockdown the Reserve Bankf of New Zealand decided not to take any action earlier today as widely expected and kept policy on-hold due to general uncertainty over the economy from this week’s lockdown.

The NZDUSD pair spiked lower and then higher. The reason for the spike higher was due to the fact that Governor Orr appeared supremely confident that today’s decision not to hike was just a blip.

See real-time quotes provided by our partner.

The ActivTrader Market Sentiment tool shows that traders are broadly bearish towards the US dollar’s future path. It should also be noted that traders are very bearish towards sterling and very bullish towards the euro, so it could be an interest morning for the EURGBP pair.

Traders are investors are braced for an extremely busy European trading session as we see the release of UK inflation data and also inflation data from the eurozone. As things stand the major index are expected to open mildly positive.

During US trading session today as the Canadian economy comes into focus as we see the release of Canadian July CPI. We also have EIA crude stockpile data, and of course the release of the FOCM meeting minutes later today. The FOMC minutes are lagging, so I suspect the market reaction will be muted.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.