Market Brief

See real-time quotes provided by our partner.

During the overnight trading session, the market sentiment was risk-off as fears mounted that tomorrow the US would have to tighten aggressively to combat inflation. A rise in Covid cases in Beijing has also adversely affected sentiment as a Chinese lockdown just adds to the supply chain disruption and economic pressures being faced by everyone else. The VIX is elevated and this not only points to the uncertainty in the markets but for traders to expect bigger range expansions and volatility.

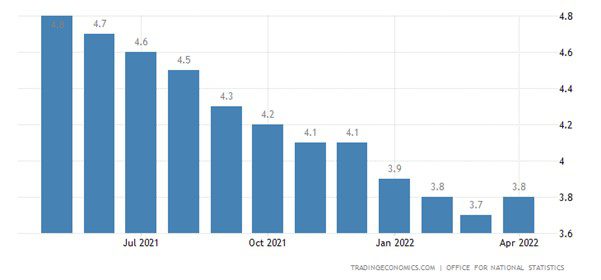

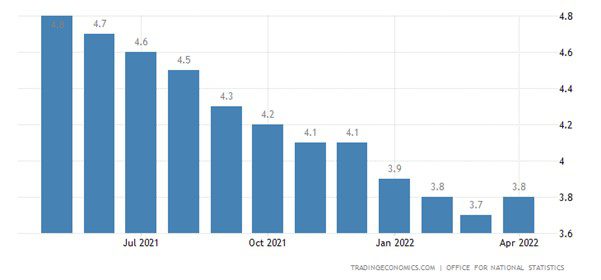

In the three months to April, UK labour market data released this morning showed an unexpected rise in unemployment from 3.7% to 3.8%. Analysts expected a decline to 3.6%. Meanwhile, economic inactivity declined. The headline earnings growth of 7.0% was downgraded to 6.8%, while underlying wages (excluding bonuses) remained steady at 4.2%. There are now more jobs open than ever with 1.3 million vacancies, but the pace of hiring has slowed.

See real-time quotes provided by our partner.

The GBPUSD has been affected largely by the US dollar surging higher and the worsening economic sentiment in the UK. However, a sweep of a significant swing low could have been a bear trap, especially if the Fed do not now push for the 75bps rate hike. This morning, the ZEW investor survey for the Eurozone will be released. According to the expectations index, both the present situation and the indices of expectations should have improved but are expected to remain negative. If the ZEW survey comes in strong this could help the EURGBP higher, which then adds more pressure to the downside for the GBPUSD.

The most likely data point to move the US dollar today is the US PPI in the afternoon. According to forecasts, producer price inflation will remain elevated at 10.7% y/y in May. That follows last week’s CPI inflation data that surprised on the upside, prompting speculation about a more aggressive Fed policy tightening.

See real-time quotes provided by our partner.

The USDJPY is showing that the US dollar is holding on to its strength as the markets would usually be moving into the safe haven of the yen when there is this much fear in the markets. The BoJ announced an addition to their auction schedule, and they will be increasing purchases of the JGBs. A bid from the BoJ is going to help keep the yen weaker.

See real-time quotes provided by our partner.

The S&P500 has held yesterday’s lows and there are a couple of gaps above which will be filled at some point. Would be great to see it happen today but that is unlikely. Looking to the left there are a couple of swing lows to aim for and on the weekly chart there is the 200-period moving average to tag.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.