The next two weeks will continue to be of great uncertainty, with the positive news likely to be an oasis in the huge noise desert. According to a survey by the S&P, about 79% of the companies that make up the index (S&P500) are being affected by the pandemic and respective measures to contain it, while at the international level China is now preparing to receive the second negative impact of this situation due to the reduction in demand from its largest customers, grappling with strong contractions in economic activity. In India the situation has been and will be challenging, given the nationally imposed quarantine that forced large consulting firms to shift most of their workers to telework, we speak of giants such as Tata Consultancy and Infosys, which in turn are fundamental to ensuring the continuity of operations for many of the largest companies globally.

So, despite the recovery of last week, for now the buying pressure was just a technical rebound movement, since the indicators were already somewhat over-sold, even at the level of the medium-term analysis. The congressional approval and subsequent Trump signature of the two trillion dollar (US) package for the largest economy in the world, was an important data to support some sentiment, however not only is this already reflected in market prices, but the rain of bad news about the American economy in general and companies in particular has only just started, noteworthy are the non-farm payrolls that will come out on Friday and that will give a perspective on the initial impact of the economic consequences of pandemic in the labour market, the sector that had been holding the bull market on Wall Street.

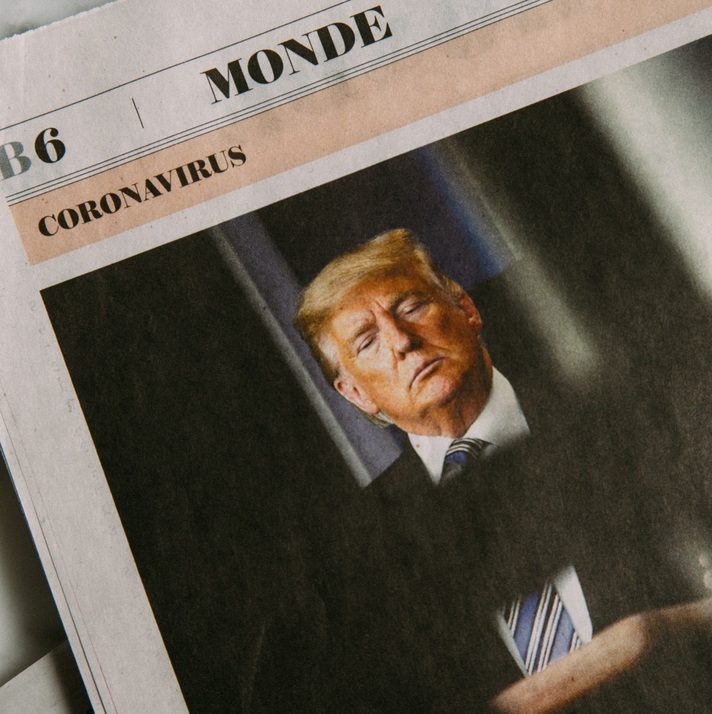

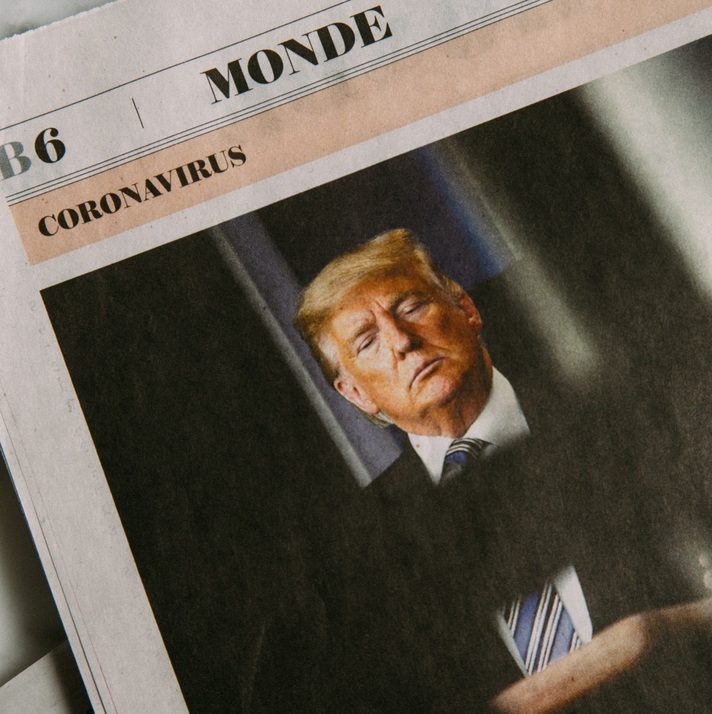

Photo by Charles Deluvio.

Marco Silva is a Financial Market Specialist with 20 years of experience, with transactions in 12 different countries, involving numerous financial instruments, Specialist in Technical Analysis, Capital Manager, Investment Advisor, Financial Hedging Operations and Algorithm trading developer. Economic Commentator TV and RTP Information for the Financial Markets, Responsible for the Department of Economy / Markets of TVL.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.