The US dollar remains under pressure in early-Wednesday trade after the greenback started to sell-off sharply into the London fix on Tuesday. No big market catalyst behind the sell-off in the buck, so the reasoning behind the reversal could be technical, after bulls failed to take-out the February high on the US dollar index.

News that the United States could have most Americans fully vaccinated by May, instead of July, certainly helped risk-on sentiment. This development clearly prompted a more positive tone towards the US economy and propelled stocks higher, and perhaps drove demand for riskier currencies.

The Aussie has seen plenty of action this morning and has rallied towards the 0.7840 area over better-than-expected Australian Q4 GDP data. The report showed that Australian GDP grew by 3.1% during the fourth fiscal quarter, marking the second consecutive quarter of economic growth.

Inside the report a number of positive developments painted a bullish picture of the Australian economy, with strong expansion seen in the labour and housing market. Infrastructure spending also saw a strong uptick. The report will make it difficult for the RBA to keep rates at record low levels.

Asian markets had a stronger session, with the Hang Seng having a blockbuster +2% session, while the Nikkei 225 traded higher by around +0.50%. European markets are called to open higher as risk-on sentiment remains at elevated levels. Gold and silver are attempting to recover, however, both metals still look in bad shape after last week’s big price drop.

Sterling is receiving a boost today, following news that UK Chancellor Rishi Sunak is going to extend the UK furlough scheme until September. Sunak is set to deliver the United Kingdom budget later today. This could be a big mover for the pound and the FTSE 100.

The euro currency has seen a big reversal against the US dollar after briefly dropping below the 1.2000 support level yesterday. The EURUSD pair is now pressing towards the 1.2100 level, expect the bullish bias to continue with the 1.2060 support level holds.

Data Watch

The economic calendar is very lively during the European session as we get a final snapshot of European PMI activity. Traders also look to eurozone PPI data and a scheduled speech from the ECB member Panetta.

A busy day for sterling traders as the United Kingdom releases Services PMI data and the UK budget. Services makes up around 80% of the United Kingdom economy, meaning that the market pays close attention to this report. The February UK Services PMI is expected to have seen a strong improvement from January.

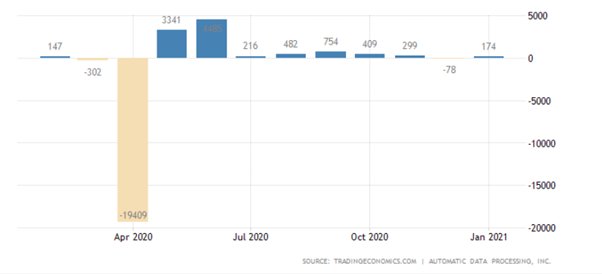

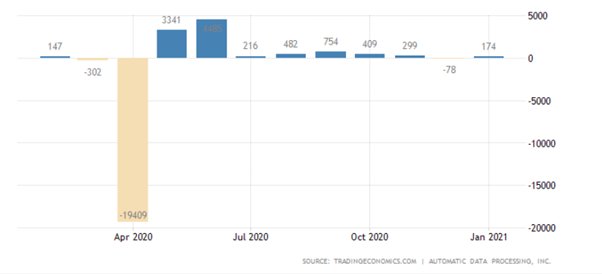

Moving into the US session the ADP Private Sector job report is expected to move the needle for financial market. The February ADP report is forecasted to have grown by a solid 177,000 during the month of February. The release of the Federal Reserve Beige Book is another key data point financial markets will be watching out for later today.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.