Market Brief

See real-time quotes provided by our partner.

At the London open the equity markets are down adding to the losses in the overnight session, with the FTSE100 already down -1.0% and the Nasdaq falling by a whopping 5%. This follows a decline of 4% in the US S&P 500 equity index yesterday. The FTSE100 has come down to a potential buy level and support line, formed by the swing high on the 11th of May 2022. If price does come lower to the 61.8% or 78.6% Fib retracement, the key would be to wait for a smaller time frame reversal pattern or higher highs and higher swing lows to form. The imbalance on the H4 chart runs all the way down to 7240 so I am considering placing a buy limit there.

See real-time quotes provided by our partner.

The S&P500 is at the inflection point where the bulls really need to step in before a much larger market crash ensues. At the recent swing high, the bulls had their interest piqued because the close was above previous market structure, signalling a potential trend change.

If we see the S&P500 take out the 3850 lows, we’re back into a bearish trend and we can start to look lower for targets further down the impulsive rally from the March 2020 lows.

The Federal Reserve policymakers continued to warn about further interest rate rises in their speeches yesterday and throughout the week so far, and the earnings season is giving the market a reality check as profits are lower than last year, and forward guidance is similarly bearish.

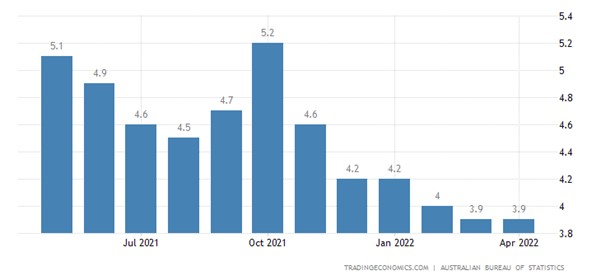

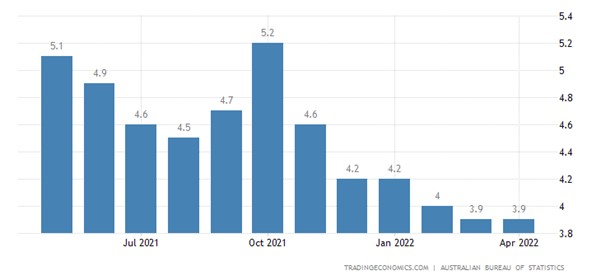

According to data from the Australian labour market, the unemployment rate fell to 3.9% in April, its lowest level since August 1974, and the number of people employed full time increased by 92.4K.

See real-time quotes provided by our partner.

The news circulating in yesterday’s late trading session was that UK Chancellor Sunak will offer targeted investment support, mostly in the guise of tax cuts to businesses, in the UK’s Autumn Budget. We will be watching today’s UK CBI industrial trends survey for signs of how recent international developments like the war in Ukraine and the recent Chinese lockdowns will impact growth and price trends. The GBPUSD has come down the high of 16th of May and to the 50% retracement level. It’s now a waiting game to see if the bulls can carve out some bullish market structure or whether the US dollar strength just drags us all the way back towards 1.2200 again.

See real-time quotes provided by our partner.

The EURUSD and other euro crosses are expected to be volatile today as the minutes of the European Central Bank’s May policy meeting may reveal more information about plans for the coming months. There have been growing indications of late that high inflation is prompting the ECB towards an early interest rate hike, possibly in July, despite ongoing concerns about economic growth. The daily chart shows how far into a bearish trend the EURUSD currently is and until we see a break and close higher than the 1.0640, I am assuming we are to keep heading down towards parity. The 1.0400 has offered some relief and todays ECB minutes may be the catalyst that decides the cross’s fate.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.