Market Brief

The overnight session has resulted in a mixed bag for global indices after the big bullish moves in the previous sessions. The moves started after Fed Chair Powell said that the Federal Reserve would not hesitate to move rates above their ‘neutral’ level if necessary to slow demand, and that interest rates would continue to rise until inflation is declining ‘clearly and convincingly’.

See real-time quotes provided by our partner.

The highs from Monday are where I expect the bulls to step in again, assuming they are still present. If we find support there, the next levels to consider are 4300 and the double top. If there is to be a larger pullback we could be coming down to the high from the 12th of May.

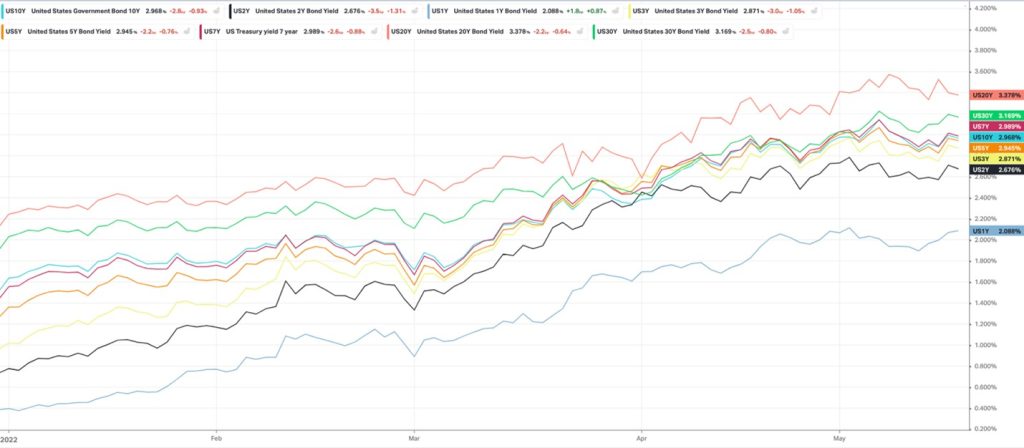

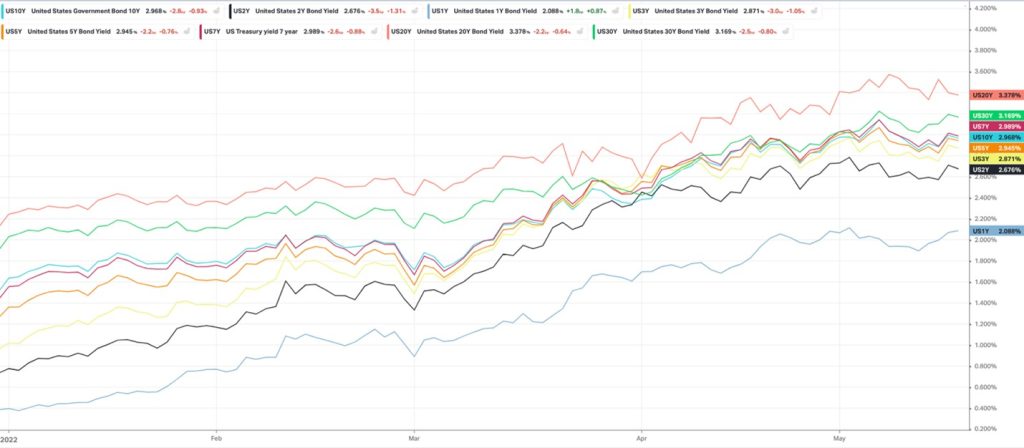

Before Fed Chair Powell spoke, FOMC member Bullard alluded to the fact that short-term government bond yields and mortgage interest rates had moved higher since the Fed had switched to hawkish forward guidance and began raising rates. In his mind, the Fed is not lagging far behind, and he expects inflation to peak sooner that maybe first feared.

Powell expressed expectations of further 50bp hikes at the next two Fed meetings in June and July and left the door open to further half-point hikes in the event of a need. There is a possibility that the Fed will overcompensate for its delay in raising rates, which could lead to a recession, hard landing, or pain trade. We will closely monitor the impact of higher interest rates on the US housing market this afternoon as the consensus is for housing starts and building permits for April to show declines.

We have another day of waiting for the talking heads to say their piece. Harker will discuss the economy’s outlook. Plus give more colour to rate hike expectations at the June and July monetary policy meetings, bringing the target range for the federal funds rate up to 2%.

Fed Chair Powell’s hawkish comments yesterday resulted in a sell-off in government bonds, with 10-year Treasury yields moving back up towards 3%. Today’s London session shows that most US yields are once again dipping.

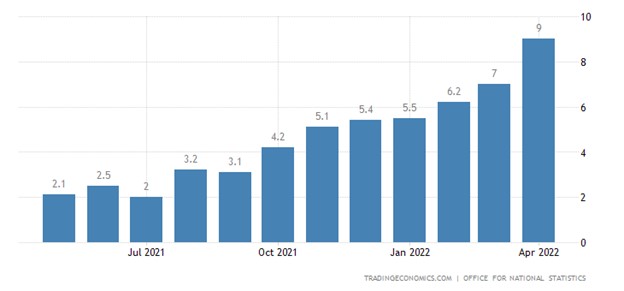

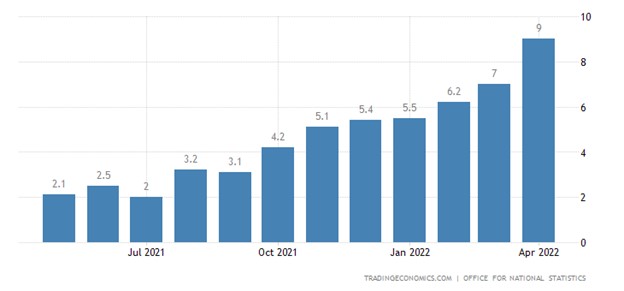

Annual UK CPI data shows inflation up from 7.0% to 9.0% in April. Although this is slightly lower than expectations for 9.1%, it is still the highest rate since 1982. The rise was pushed by energy prices due to a significant increase in the Ofgem energy price cap. The price of food and restaurant meals also had an impact. (Excluding food and energy) Core CPI inflation rose to 6.2% from 5.7%. Further increases in energy prices may push overall inflation to new highs later this year.

See real-time quotes provided by our partner.

The GBPUSD jumped yesterday on stronger-than-expected UK labour market data, although it is a little lower this morning. The resistance came from the lows of May the 4th, which was the day the FOMC rate hike was announced. The target is still the highs of the BoE rate hike, but we may have to wait for a pullback to 1.2300 to find more buyers.

Inflation figures for April will also be released for the Eurozone and Canada later today.

See real-time quotes provided by our partner.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.