Market Brief

See real-time quotes provided by our partner.

It’s April the 1st, so the start of a new month, a new quarter and at the start of the London session the market is quite directionless. Global equities are mixed, oil prices are in a tight range after the US announced plans to release its strategic oil reserves. The S&P500 has a few targets to the upside before making all-time highs. As we’re not that far away we have to consider that there is a possibility that this rally continues but I favour a retest of the lower imbalances first as that would confirm the support is there.

See real-time quotes provided by our partner.

Ceasefire talks between Ukraine and Russia are expected to resume today, but the West is telling President Zelensky to not rush into making a deal with Russia. Russia has backtracked on its demand for payments in roubles for its gas supplies to Europe, and reports are coming through that the pipelines are being shut due to a backup in oil storage.

Brent is on the cusp of breaking through a trendline and if there hadn’t have been a missile attack on a Russian fuel reserve facility, I may have called for lower prices this morning. However, we need to wait for the market to digest what this new event means and whether the Russians allow payments in euros and dollars for gas into Europe.

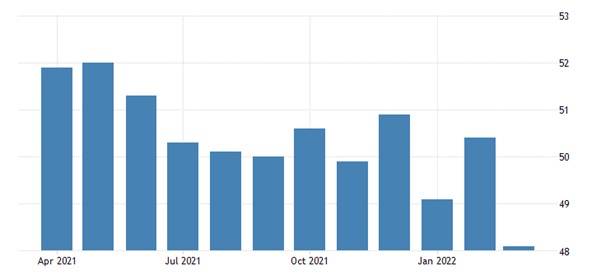

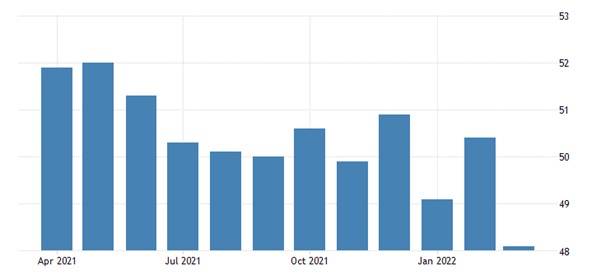

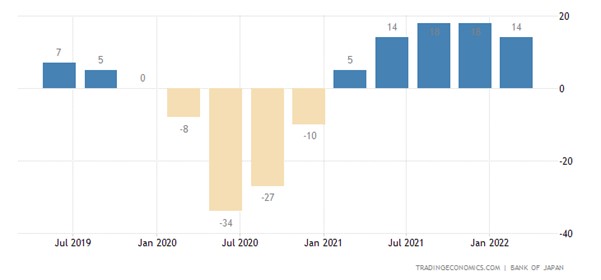

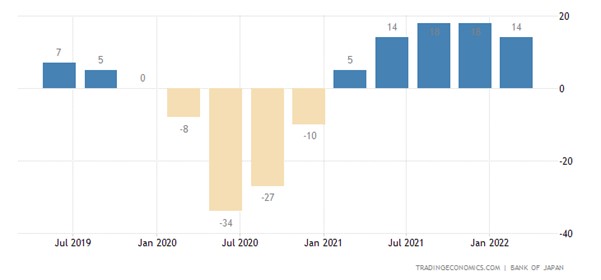

There were several business surveys released overnight. China’s Caixin manufacturing PMI fell to 48.1 in March from 50.4 in February, while Tankan in Japan showed large manufacturers’ outlook fell to +9 from +13 in Q4 last year.

See real-time quotes provided by our partner.

The USDJPY has broken out of the descending channel and is now making higher swing highs, so I am expecting a retest of the old support which became resistance, to on this second time of asking to give way to higher prices.

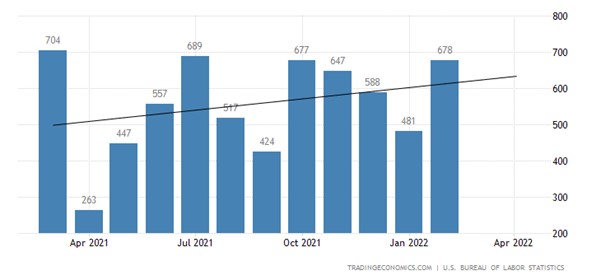

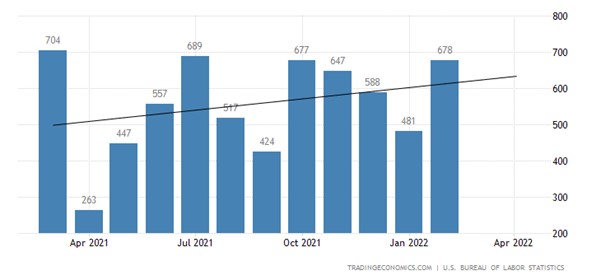

Today’s market focus will be the US NFP jobs report. Next month we get the Fed policy update, so today’s NFP figure will go some way to giving the market an idea of the probability of a 50bps rate hike. Expectations are for the nonfarm payrolls to show another strong monthly increase with the trend now above 500k. The unemployment rate is forecast to fall to 3.7%, almost back to pre-pandemic levels, and annual earnings growth is expected to accelerate to 5.7% from 5.1%.

See real-time quotes provided by our partner.

Markit Economics published a final report this morning that shows manufacturing activity in the eurozone declined in March compared to the previous month, with the PMI dropping to a 14-month low of 56.5 points. The Manufacturing Output Index fell to a 21-month low at 53.1 points because of surging inflation in the EU and increased tensions between the West and Russia.

The EURGBP broke through some intraday support with good momentum and now the idea would be to wait for a retest of that zone marked in red to see if it holds as resistance. Fundamentals this morning suggest that this is the likely scenario, but with peace talks and NFP today, we could be in for some volatility.

See real-time quotes provided by our partner.

We will also receive the US ISM manufacturing survey. A small fall in the headline index to 58.3 from 58.6 is expected. After Covid outbreaks in parts of China caused reported shutdowns and inactivity, the survey’s details will be scrutinized for signs of possible worsening supply chain disruptions.

The US dollar index is in a range, which is well defined, so trading in the middle of this range is probably the worst idea unless you have a mean reversion strategy. For me, the best idea would be to wait for a reversal, or breakout at the edges of the range.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.