Market Brief

Russian paratroopers drop into Ukraine’s second city Kharkiv after US President called on Congress to show that the US stands with the Ukrainian people. Ukrainian allies including the US have banned Russian flights from using US airspace and the Russian bank Sberbank has said it is leaving the European market citing that it would not be able to supply liquidity to European units. All the while Germany is still receiving energy from Russia which means the European Union is still funding the Kremlin. The hope is that new Russian/Ukrainian talks will be possible at the end of this week though the two sides are diametrically opposed with zero common ground.

See real-time quotes provided by our partner.

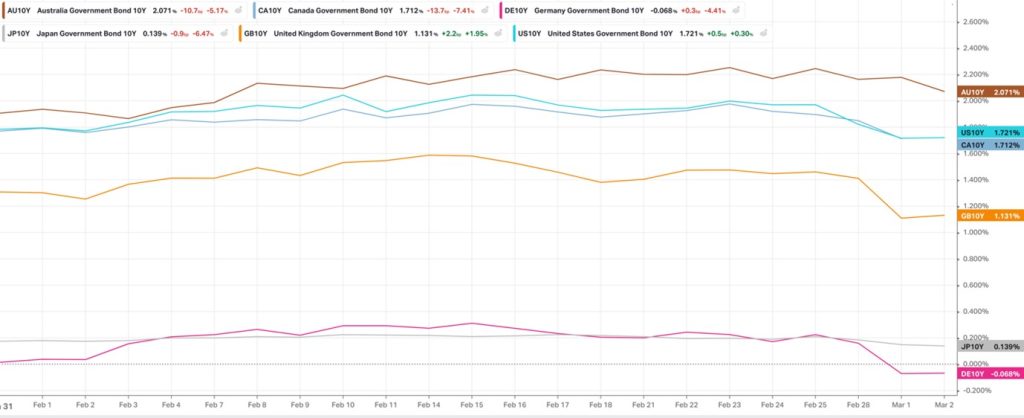

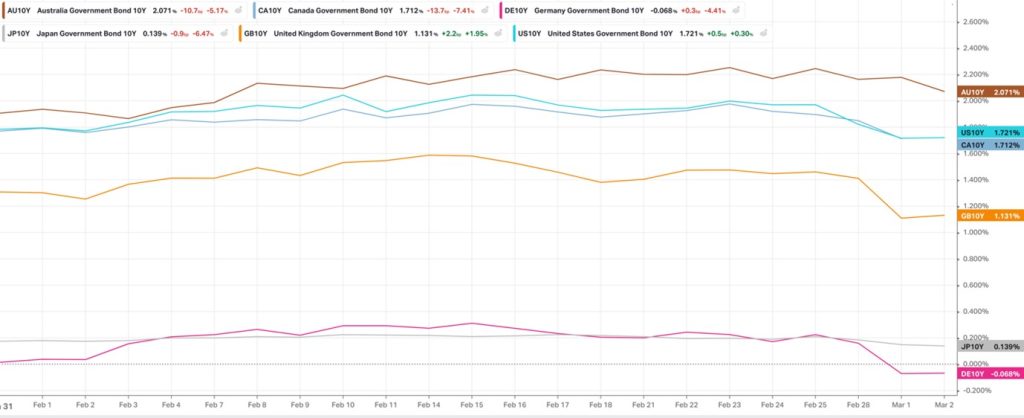

Yesterday the markets ended risk-averse with the TLT rising, the fixed income yields falling and the safe-haven currencies rising. Today we will hear from Fed Chair Powell as he testifies on the Semi-Annual Monetary Policy in Washington D.C., and this should give the markets a hint of whether the Fed is more cautious now that the situation in Ukraine is worsening. On the TLT chart, the price action has run into the dynamic resistance of the moving averages but also the previous balance area. For the bond buyers getting in when no one else wants them seems to be the clearest way of making money but I would find it hard to get bullish until we get through this heavily traded zone.

See real-time quotes provided by our partner.

See real-time quotes provided by our partner.

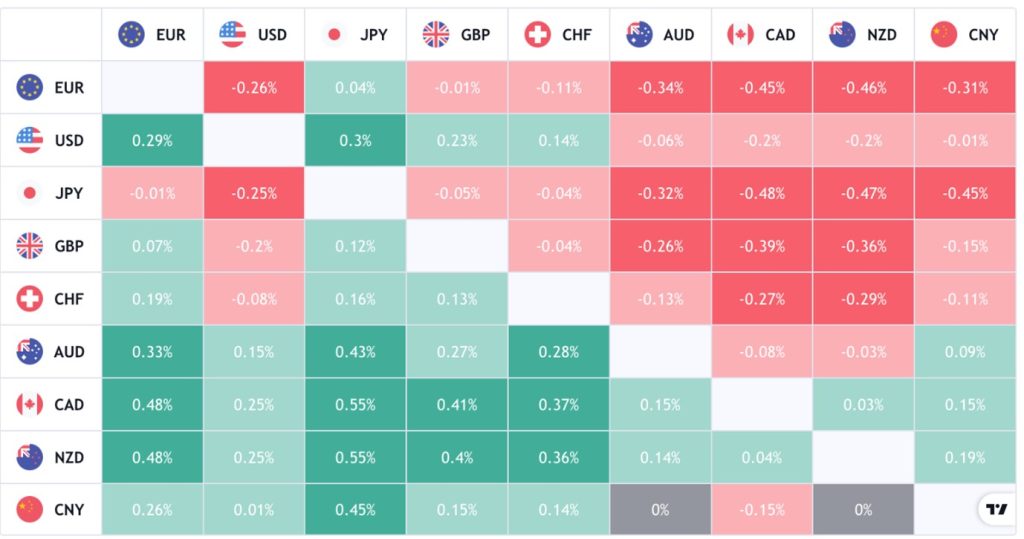

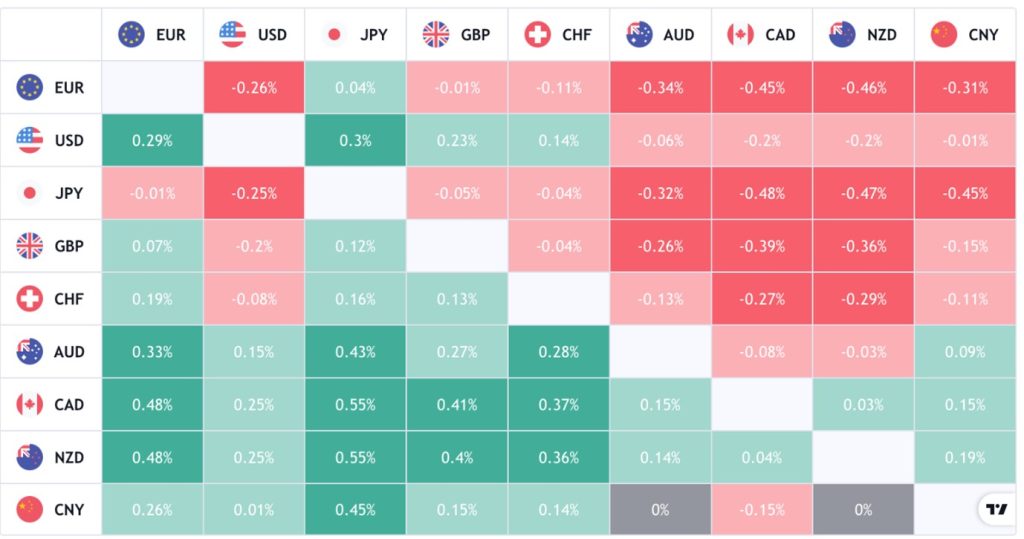

The forex heatmap illustrates that London opens optimism in the forex markets as the commodity pairs have turned the bottom left corner solid green, while the top right-hand corner is red.

The OPEC+ meeting today will add colour to the US Crude Oil Inventories as Brent and WTI reach for prices not seen since August 2013.

See real-time quotes provided by our partner.

Assuming we will see higher oil prices today, the Fibonacci extension tool points to $121 per barrel at the next extension level and at this pace, we could be there by the end of the week.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.