During the upcoming trading week, the economic calendar is heavily dominated by central banks, as we the release of meeting minutes from the FOMC and the Reserve Bank of Australia.

Other key highlights on the economic docket this week include the release of United States monthly retail sales and also Gross Domestic Product data from Japan and the eurozone economies.

This week will also see the release of the Reserve Bank of New Zealand policy decision, and a raft of important data points from the Canadian economy, including retail sales and CPI inflation.

FOMC Minutes + US Retail Sales

The undoubted highlight on the economic docket this week is the FOMC meeting minutes as taper talk starts to increase after the recent robust July employment report with showed that nearly one million jobs had been created.

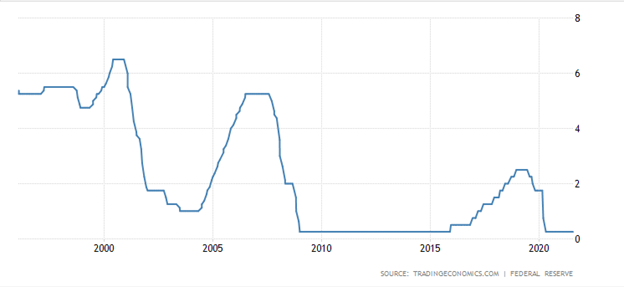

At the last policy meeting the Fed left the target range for its federal funds rate unchanged at 0-0.25% and bond-buying at the current $120 billion monthly pace during the July 2021 meeting.

Traders will be waiting to see if the central bank will offer some hints that asset purchases could start being reduced soon in spite of the threat to growth from delta variant of the coronavirus.

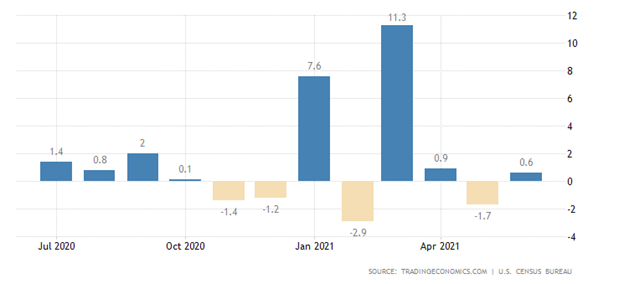

Retail sales data is also set for release this week, with most economists expecting a -0.2-headline number. The market reaction is unlikely to be too severe as retail sales have been historically volatile, as highlighted by the chart below.

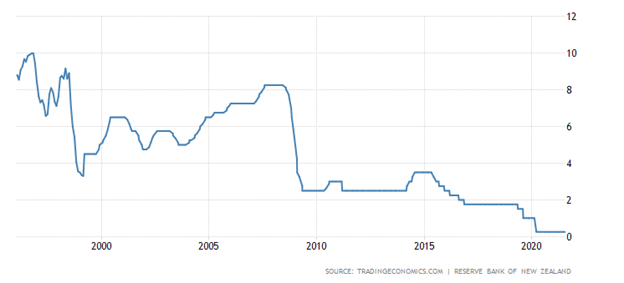

Reserve Bank of New Zealand Rate Decision

The Reserve Bank of New Zealand could be the surprise of the week, with some economists expecting that the central bank could be one of the first major central bank to take hawkish policy action, and actually raise rates.

Last month the RBNZ held its official cash rate at a record low of 0.25% but decided to halt additional asset purchases under the Large-Scale Asset Purchase program by July 23rd.

Policymakers said some monetary stimulus remains necessary, but its level could be reduced to minimize the risk of not meeting consumer price and employment objectives over the medium-term.

Watch out for a big reaction in the New Zealand dollar if the central bank act accordingly and raise rates, because as things stand a rate hike does not look to be priced into the NZDUSD pair.

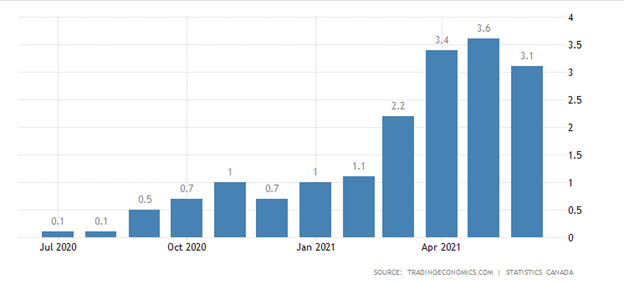

Canadian Retail Sales + CPI Inflation

The Canadian dollar could strengthen this week if we see sold retail sales and CPI numbers from the Canadian economy, at a time when oil prices and COVID-19 are driving the Loonie.

CPI is likely to be the big mover in the data release, although retail sales is equally important. The annual inflation rate in Canada eased to 3.1% in June of 2021 from a 10 year high of 3.6% hit in May and compared to market forecasts of 3.2%.

A red-hot inflation number would likely see the Bank of Canada thinking hard about raising rates and being another central bank that be about to act before the Federal Reserve.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.