Trading biases are building ahead of the June Non-farm jobs report from the world’s largest economy. With that said, now could be a good time to look to fade extreme sentiment biases as traders are notoriously bad at predicting the outcome and market reaction to the report.

Historical data has shown that one of the best ways to use sentiment in trading is to watch for overcrowded trades that are running counter trend. This is where the ActivTrades Market Sentiment tool is very effective.

Closely watching what the retail crowd is doing and actually fading them is a viable trading strategy. This is most effective when retail traders are running counter trend, meaning that they are heavily leaning against established market trends.

Typically, market sentiment readings for an instrument that has reached around 75 to 80 percent is considered to be at an extreme level, while market sentiment readings over 80 to 95 percent is often a strong indication that the trade could be peaking, and about to reverse at any time.

Neutral reading typically indicate indecision or point to more range bound conditions, while sudden shifts in sentiment can potentially mark trend reversals. With that said, I will now look at some the strongest sentiment trades amongst the retail crowd right now.

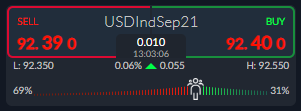

US Dollar Index- Bearish Bias

According to the ActivTrader Market Sentiment tool some 69 percent of traders are currently bearish towards the US dollar index. The US dollar index performed well in June and is trading above its 200-day moving average.

The current sentiment skew suggests that the index could move even higher over the coming weeks. Personally, I believe we probably need to see retail traders turning extremely bullish in order for US dollar weakness to resume..

It is fair to say that looking on the chart bulls would need to overcome the 93.50 level to really get the bullish breakout into hyperdrive. It is still very uncertain whether the greenback can rally towards 93.50.

Silver – Too Bullish

The ActivTrader market sentiment tool shows that traders are ultra-bullish towards the price of silver right now, with 87 percent of traders betting towards further gains in the shiny metal.

Silver has recently staged a minor bounce from the technically important $26.00 support area, but it still remains far from the danger zone and would need to move above $29.00 before I would agree with the current sentiment skew is wrong.

It should be noted that retail traders are not always wrong, although historical data has shown that they are often on the wrong side of the market when trends are in play, so silver bulls should trade carefully if silver crashes under its 200-day moving average and the trend turns bearish.

CADJPY– The One To Watch

Market sentiment towards the CADJPY pair is still at very extreme levels, with the ActivTrader platform currently showing that 88 percent of traders are bearish towards the CADJPY pair.

Traders are growing more bearish despite the fact that pair is testing the top of its multi-year trading range and the USDJPY pair is starting to break out to the upside, which is often a warning to other yen pairs.

CADJPY bears must note that the weekly chart shows clearly that a multi-year trendline breakout could take place if the CADJPY pair trades above the 91.00 level. If traders remain extremely bearish and the price breaches the trendline a parabolic move could easily take place.