During the upcoming trading week, the release of the United States Consumer Price Inflation and Retail Sales data is set to be the main focus for financial market participants, as signs of inflation and increased consumer spending start to show up in the US economy.

Other key highlights on the economic docket this week include the Bank of England Governor Andrew Bailey holding a number of scheduled speeches after last week’s mildly dovish rate and monetary policy decision.

This week will also see Q1 GDP numbers from the United Kingdom economy, and monthly retail sales data from the Australian economy. Consumer confidence and weekly jobs data from the United States are also scheduled for release on the economic docket.

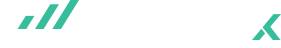

US Consumer Price Inflation & Retail Sales

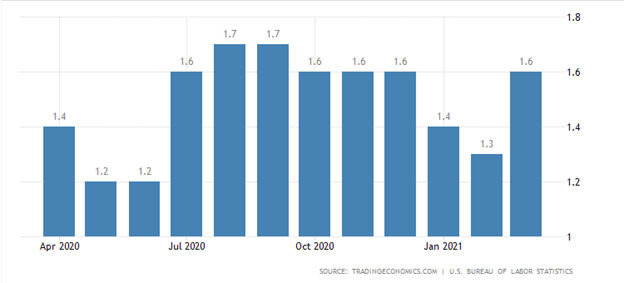

Traders will be braced for more volatility this week as US CPI inflation data is released, at a time when inflationary pressure is a hot topic amongst financial market participants. Current estimates suggest that month-on-month inflation is going to drop sharply against last month’s 0.6 percent rise.

Economists are predicting that CPI inflation will rise 0.2 percent while year-on-year inflation is set to rise by 2.3 percent. Things could be interesting if the annual CPI comes in on target, as year-on-year CPI inflation is set to break above the FED’s 2 percent target.

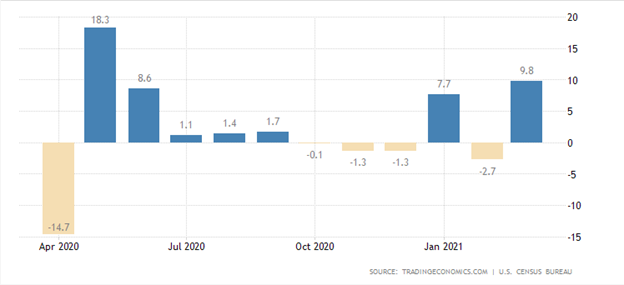

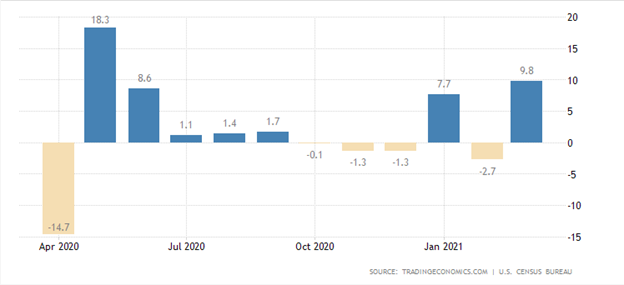

Traders will also look to key retail sales data from the United States economy this week. Economists are expecting a 0.2 percent uptick, while is a big drop on last month’s 9.8 percent headline number.

Retail spending is the lifeblood of the United States economy, so traders and investors do pay particular attention to it, despite its constant unpredictability. We should probably expect to see more US dollar weakness if the US consumer spending slumps as expected.

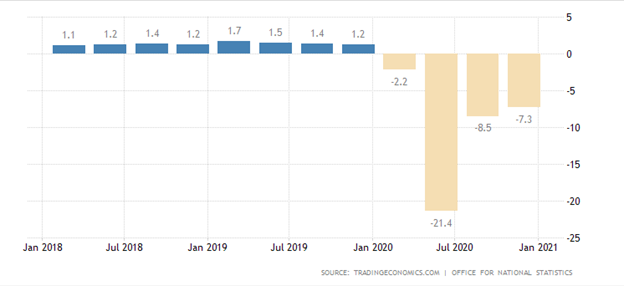

UK Gross Domestic Product

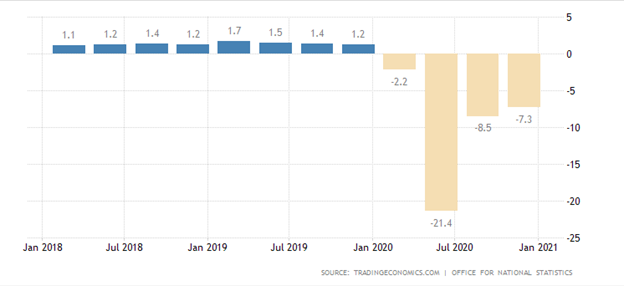

Quarterly GDP is expected to show that the United Kingdom’s economic growth rose by 0.5 percent goring the first fiscal quarter. A somewhat weak number is expected because the UK economy basically remained in lockdown for most of the first fiscal quarter, and only came out of lockdown a few weeks ago.

UK GDP fell by 7.3 percent year-on-year during the last three months of 2020, which was slightly better than the 7.8 percent drop predicted.

Traders and investors will be looking for clues about the United Kingdom’s economic health inside export and important data after its recent separation from the European Union at the start of the year.

I would suggest that unless we see a big shock to the downside then the market’s reaction to this number may be muted. Financial markets are forward looking, so we should expect that economists will pay more attention to UK growth after lockdown, and the Q2 UK GDP number.

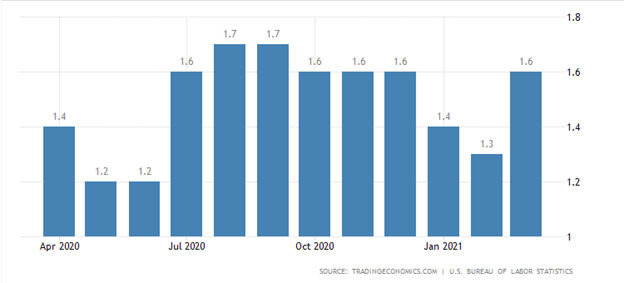

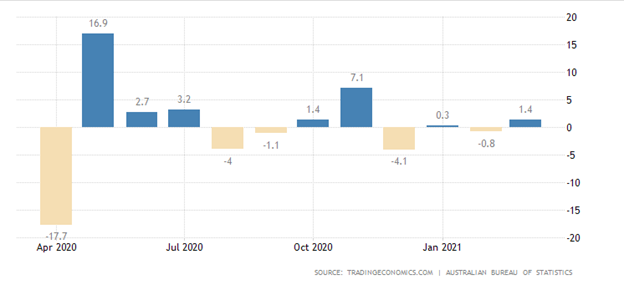

Australian Retail Sales

The Retail Sales release is a big deal for the Reserve Bank of Australia, as consumer plays a big role in the central banks’ decision making. Australian retail sales rose by 1.4 percent month-over-month in March 2021, reversing from a final 0.8 percent drop in the prior month, which beat market estimates of a 1 percent increase.

Last month an improvement in consumer confidence and a reopening of state borders. Cafes, restaurants, and takeaway food services led the rise by industry, driven by increases in Victoria and Western Australia.

Watch the Australian dollar’s reaction as we get the April headline number, it is unlikely to be a game-changer for the RBA, as we probably need to see CPI inflation coming in hot for the central bank to act next month.

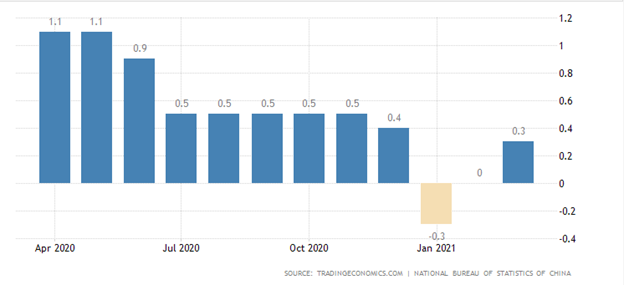

Chinese Consumer Price Index

The release of the Chinese CPI will provide a strong hint of whether inflationary pressure is starting to creep into the Chinese economy. Inflation is certainly hitting the western world right now.

Rising inflation in China could prompt concerns that Chinese companies will have to counter this phenomenon by raising factory cost and passing it onto the overseas consumer. Expectations are fairly low for a high number, however, this is one release that is certainly worth watching.