The US dollar index has firmed against most major currencies once again as the early-week sell-off in the buck has failed to stick. Another rise in US Treasury yields has caused a number of pairs to give back a sizeable portion of their current weekly gains against the greenback.

It certainly appears that the ongoing reversals in the EURUSD, GBPUSD, AUDUSD, and NZDUSD pairs is technically driven. Additionally, traders may be booking some profits and getting positioned ahead of today’s big CPI inflation report from the United States economy.

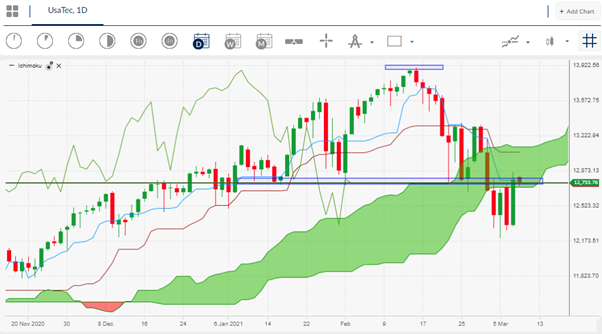

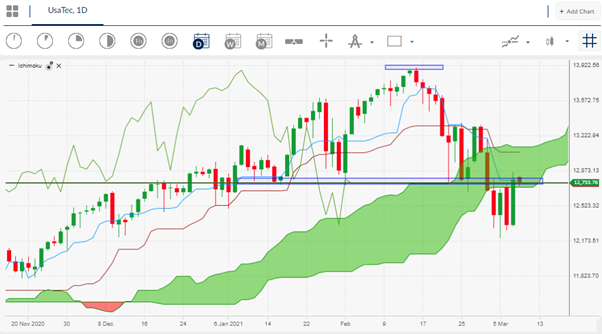

US futures are back in the red today, following blockbuster gains in the Nasdaq and Dow Jones Industrial Average yesterday. The Dow Jones Industrial Average rallied to a new all-time high yesterday as the big rotation away from tech stocks remains the number one trade on Wall Street.

Asian stocks are also a touch lower today. Chinese CPI inflation data showed that consumer deflation remains in place, as CPI contracted -0.2 percent. This weak CPI was negated as PPI inflation data released today showed Chinese Producer Price Inflation growing at its fastest pace in two years.

The AUDUSD pair is turning lower this morning, largely in reaction to US dollar strength. The Aussie showed only a muted reaction to Reserve Bank of Australia Governor Philip Lowe’s scheduled speech in late Tuesday trade.

Governor Lowe outlined that the central banks focus is on raising wage growth in the Australian economy. RBA Governor Lowe also noted the central bank is looking at getting the unemployment rate back to 4 percent, and preference a lower exchange rate.

Commodities and metals are also heading south today. WTI and Brent oil are giving back some gains, following news that US API stock inventories grew by 12.79 million barrels. Gold and silver are also sinking into negative territory again.

Bitcoin has pulled back sharply alongside Ethereum and Litecoin after the top crypto moved within touching distance of $56,000. Cryptos, and especially Bitcoin have had an increased relationship with S&P 500 and the Nasdaq recently, and also US Treasury yields.

Data Watch

The economic calendar is empty during the European session, which places an almost ominous focus on the high-impacting US CPI inflation report later today, the US 10-year Treasury Auctions coming during the US trading session.

The Bank of Canada is another major focus for traders today, at a time when oil prices are proving to be a major positive for the Canadian economy, and a key reason why the Canadian dollar is holding up against the buck.

Today will be a big test for US equity markets after yesterday’s gains. The recent trade has been to sell the rallies in the S&P 500 and the Nasdaq, meaning that if this theme returns, we could soon a bloodbath in tech stocks. The 10-year Treasury auction will also be a big deal, and a major focus of stock and bond markets.

© 2019 High Leverage FX - All Rights Reserved.

© 2019 High Leverage FX - All Rights Reserved.